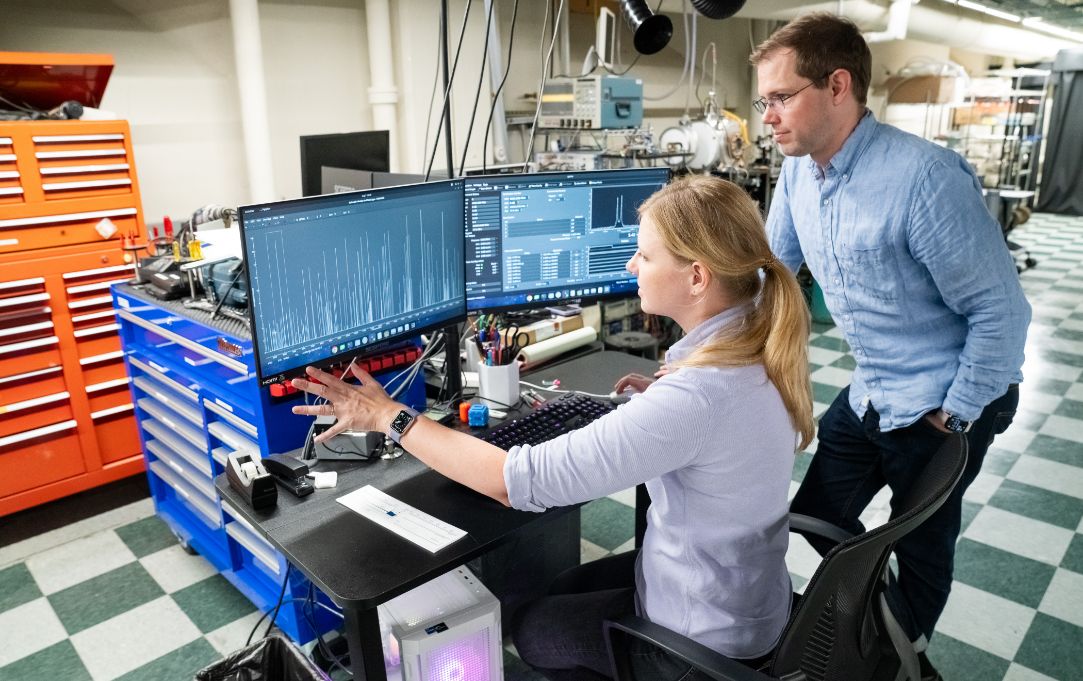

MIT’s innovative research and transformative education are made possible by a robust endowment fueled by generations of people and families who’ve believed in strengthening our future.

Endowment explainer

MIT’s endowment is not a savings account with flexible funds that can be accessed for any purpose. Here's why:

The MIT endowment is not a single pot of money.

It’s a collection of more than 4,500 individual funds.

The bulk of which were gifts from MIT’s donors.

Endowment gifts come with rules.

When someone receives $100 as a birthday gift, they can do anything they want with every dollar. But when MIT receives a gift for its robust endowment, it does not have that same flexibility.

The use of the endowment is governed by a state law that requires MIT to:

- Maintain each endowed gift as a permanent fund

- Preserve its purchasing power

- Spend it as directed by its original donor

In other words, an endowment is like a retirement annuity that provides income every year for the remainder of the owner’s life – and MIT’s lifespan, we hope, is very long.

Endowed funds enable MIT to support costs today and continue to support them as they grow over time with inflation. It provides perpetual funding. Here’s how:

Example: $100 being used to fund a salary

- You are paying someone an annual salary of $5

- Next year, due to inflation, the salary would need to increase by 3% to $5.15 to hold the same value

- The following year, it would need to increase to about $5.30, and so on

- Continuing at this rate, the $100 gift will be depleted in 16 years

If you fund this position by spending down a $100 gift, the gift would quickly be depleted. And then you could no longer afford that job.

This is not what MIT donors envision when they make an endowed gift.

In contrast,

- You invest the endowment

- Let's say it grows by 8% annually

- Factoring in 3% for yearly inflation

- That leaves 5% to distribute each year

Used in this way, an endowed gift can support that job long into the future. This is the concept of endowment.

If you spend more than 5% – triggered by wanting or needing to do something new, or by wanting to use endowment to cover a loss in other revenues – the math no longer works.

To manage spending from its endowment, MIT follows the principle of “intergenerational neutrality” – or in simpler terms, taking the long view. Previous generations of MIT preserved resources so there could be an equally impactful MIT today, and we are doing the same for future generations.

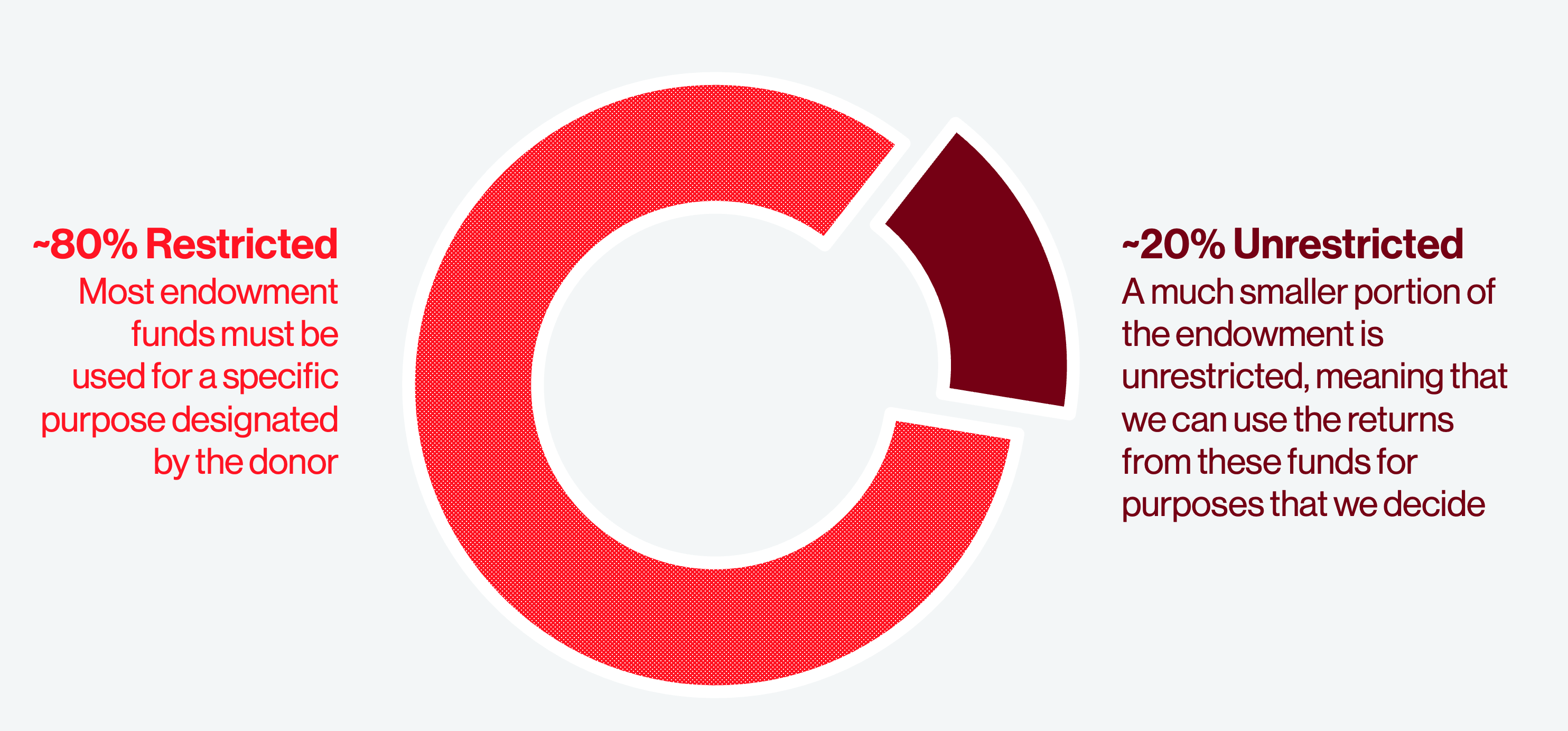

Most of the funds comprising our endowment’s returns must be used for the specific purpose designated by their donors – for example, to fund professorships, scholarships, or research.

A much smaller portion is unrestricted, meaning that we can use the returns from these funds for purposes that we decide.

Increasing the endowment tax paid by MIT from 1.4% to 8% directly reduces funds for financial aid and research — undercutting American families, American innovation, and American competitiveness.

Enables robust research and strong student aid

Resources from our endowment and other investments provide approximately 40% of our annual budget and enable both robust research and strong student aid.

For example, the endowment enables MIT to co-invest, nearly 1-to-1, the $800 million our labs receive annually in external research grants.

Free tuition for most American families

MIT’s endowment allows us to offer free tuition for families earning less than $200,000, and attendance at no cost to families earning less than $100,000.

In fact, MIT is affordable and a leader on economic mobility: 60% of our undergraduates receive financial aid from MIT; nearly 40% of our undergraduates attend completely tuition-free; and MIT is ranked #1 by the Wall Street Journal for graduates’ starting salaries and is first for economic mobility.

Contributions to American innovation

MIT has an unparalleled history of contributions to American innovation: Over the past century, MIT scientists have conducted pathbreaking and sustained work in critical fields such as radar, computing, aeronautical navigation, artificial intelligence, and fusion — plus unclassified and classified defense research and technology development that benefits national security.

Benefits the nation through military education, leadership, and service

MIT benefits the nation through military education, leadership, and service: Over 12,000 military officers have been commissioned from MIT, with more than 150 reaching the rank of general or admiral. These programs, too, are supported through the endowment.

Advances American students, innovation, and competitiveness

Cutting into our endowment with taxes would weaken all these efforts — and would undercut American students, innovation, and competitiveness. Taxing charitable endowments cuts into the impact of charitable giving and could serve to discourage future giving, multiplying the negative impact.

Bottom Line

MIT’s endowment supports research, student aid, and innovation. Taxing it at a higher rate will weaken these efforts and hinder future contributions.